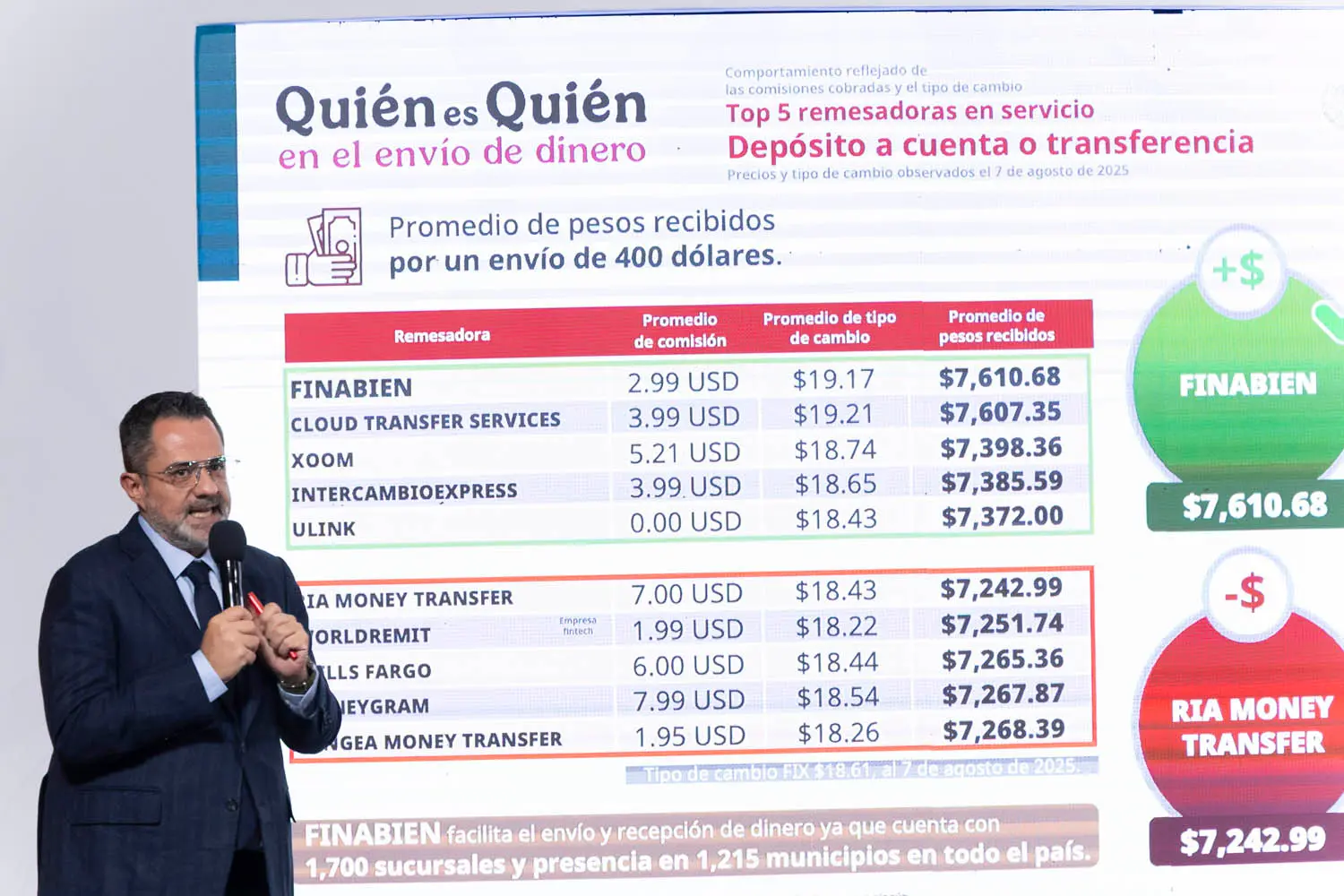

The Financiera para el Bienestar (Finabien) ranks first among money transfer companies for sending money from the United States to Mexico, providing 7,610.68 pesos for every $400 USD sent, according to the latest “Who’s Who in Money Transfers” report from the Federal Consumer Protection Agency (Profeco).

During Mexican President Claudia Sheinbaum Pardo’s morning press conference, Iván Escalante Ruiz, head of Profeco, highlighted that in the account deposit or transfer category, Finabien leads the list of the top five remittance companies that deliver the most pesos per dollar sent, thanks to its low average fee ($2.99 USD) and competitive exchange rate (19.17 pesos per dollar).

In contrast, Ria Money Transfer delivered the least in this category, with 7,242.99 pesos.

In the cash transfer category, the best option was Pagaphone Smart Pay, with 7,607.35 pesos, while Pangea Money Transfer recorded the lowest amount: 7,231.87 pesos.

How to Get the Finabien Card

To receive remittances securely and with greater returns, Finabien offers a card with multiple benefits:

Where to get it: At Financiera para el Bienestar branches and Telecomm points across the country. Find locations at www.gob.mx/finabien.

Activation and use:

Activate the card via the official link on the Finabien website.

Download the Financiera para el Bienestar App from the App Store or Google Play.

Log in with the email and password you created upon activation.

Main features:

Receive remittances instantly.

Pay at physical and online stores.

Make SPEI transfers and deposits at branches, authorized retailers, or from other Finabien cards.

Manage your balance securely.

The card also provides access to the Virtual Vault, offering a 10% annual yield with no minimum balance or fixed terms, and 24-hour withdrawal availability.

Escalante reiterated the importance of consumers comparing fees and exchange rates before sending money, to make the most of every dollar sent to families in Mexico.

Related: Mexican Government FINABIEN Paisan@ Card to Protect Remittances from U.S. Tax