By Canal Once. Mexican Press Agency.

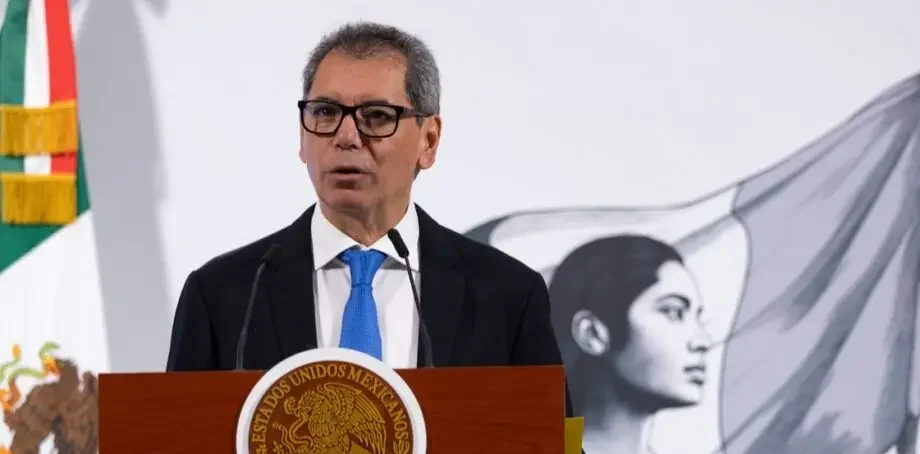

Mexico’s banking system is operating normally and remains one of the most solid internationally, said Minister of Finance and Public Credit (SHCP), Edgar Amador Zamora, following a U.S. Department of the Treasury statement that named three financial institutions in Mexico as allegedly engaged in money laundering.

“It has not experienced any disruptions and continues to be one of the strongest systems internationally, with capitalization and liquidity ratios above international standards, which ensures the proper functioning of our financial markets,” he said during President Claudia Sheinbaum’s morning press conference.

Amador emphasized that, as proof, the exchange rate has remained stable, fluctuating between 18.85 and 18.95 pesos per U.S. dollar, while local market interest rates dropped broadly by between 0.1% and 0.3%.

Ongoing Market Monitoring

The SHCP reported that it has remained in constant coordination with the Banco de México (Banxico), the National Banking and Securities Commission —CNBV— and the Mexican Banking Association (ABM) to assess market conditions.

The Ministry stated that after the close of Wednesday’s financial session, it was confirmed that the credit lines of the three institutions in question were experiencing problems.

“As a preventive measure, a temporary administrative intervention was carried out in these institutions to ensure there would be no interruptions in the banking system and, at the same time, to safeguard clients’ savings,” Amador explained.

The Minister of Finance said this decision provides certainty to savers and investors in CIBanco, Intercam, and Vector Casa de Bolsa, reaffirming the reliability of the country’s financial and banking system.